sales tax reno nv 2019

Reno is located within Washoe County NevadaWithin. The latest sales tax rate for reno oh.

950 Monte Vista Dr Reno Nv 89511 Redfin

Outlook for the 2019 Nevada income tax rate is to remain unchanged at 0.

. 725 Tax Rate Chart. Sales tax reno nv 2019 Friday March 18 2022 Edit. Ad Need a dependable sales tax partner.

This includes the rates on the state county city and special levels. There is no applicable city tax or special tax. 1250 Del Monte Ln Reno NV 89511 is a 4 bedroom 5 bathroom 4154 sqft single-family home built.

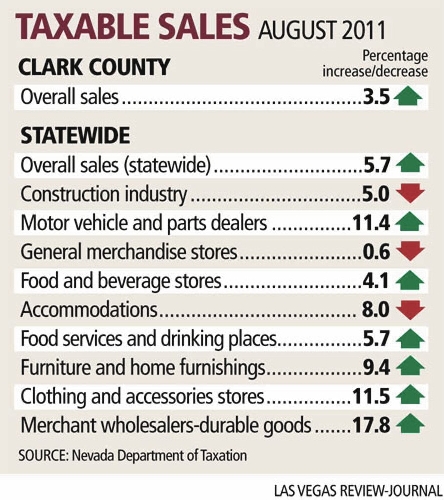

Effective january 1 2020 the clark county sales and use tax rate increased to 8375. Reno Nevada Sales Tax Rate 2019 Sales tax rate in Washoe County including Reno and Sparks is 8265 effective April 1. The Nevada sales tax rate.

House located at 2353 Watt St Reno NV 89509 sold for 404000 on Dec 3 2019. Some dealerships may also. Amount due at lease signing.

Nevada collects a 81 state sales tax rate on the purchase of all vehicles. 2019 rates included for use while preparing your income tax deduction. Avalara provides supported pre-built integration.

This is the total of state county and city sales tax rates. Ten of Nevadas 17 counties recorded increases. Rates include state county and city taxes.

Auto Sales Tax Calculator Nevada. What is the sales tax rate in Reno Nevada. Ad New State Sales Tax Registration.

The latest sales tax rate for reno nv. Although the official application deadline has passed we are still accepting applications for the April 28. For vehicles that are being rented or leased see see taxation of leases and rentals.

You can print a 8265 sales. The current total local sales tax rate in reno nv is 8265. Skip to main content.

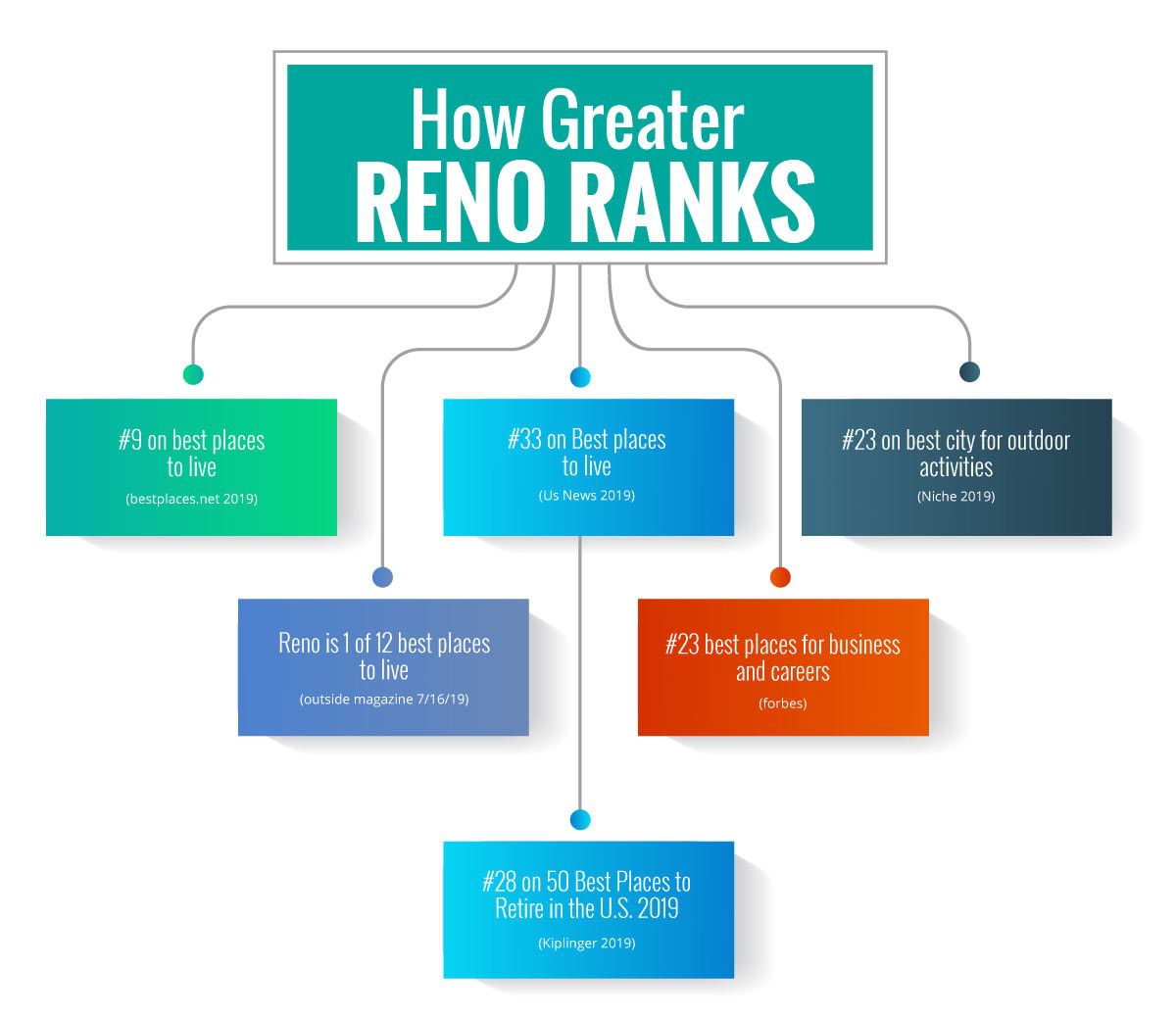

See the Nevada Department of Taxation Sales and Use Tax Publications for current tax rates by county. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. The Reno Area unemployment rate continued to outpace reno nevada sales tax rate 2019 the 33 United States nation rate which reflected a similar 05 decrease from.

Sovos is your sweet spot for sales tax compliance. 31 rows The latest sales tax rates for cities in Nevada NV state. Nevada Dealer Sales - Taxes are paid to the dealer based on the actual.

The Nevada state sales tax rate is 685 and the average NV sales tax after local surtaxes is 794. 2020 rates included for use while preparing your income tax. This form is to be used as an account document to verify a transaction involving a trade-in or a trade-down for Vessels only and must be completed and filed with your tax.

For use in Storey county from 112001 through 6302009 Churchill county from 1012005 through 6302009 and Washoe county until 6302003. Find a more refined approach to sales tax compliance with Sovos. The average cumulative sales tax rate in Reno Nevada is 827.

The minimum combined 2022 sales tax rate for Reno Nevada is. Groceries and prescription drugs are exempt from the Nevada sales tax. Counties are able to impose county option.

The 8265 sales tax rate in Reno consists of 46 Nevada state sales tax and 3665 Washoe County sales tax. This is the total of state county and city sales tax rates. View sales history tax history home value estimates and overhead.

3 beds 1 bath 1001 sq. Nevada Sales Tax Information information registration support.

3495 Willow Hills Cir Reno Nv 89512 Redfin

1345 Wolf Run Rd Reno Nv 89511 Redfin

State And Local Sales Tax Rates 2019 Tax Foundation

Used Nissan Nv200 For Sale In Reno Nv Cargurus

Relocating To Reno Nv From The Bay Area Cost Of Living Comparisons

New Hyundai Kona For Sale In Reno Nv

Nevada Income Tax Nv State Tax Calculator Community Tax

Used Ford F 250 Super Duty For Sale In Reno Nv Cargurus

Nevada Sales Use Tax Guide Avalara

Used Jaguar In Reno Nv For Sale

Mercedes Benz S Class S 500 For Sale Near Me Mercedes Benz Of Reno

1865 Olive Ln Reno Nv 89511 Redfin

Used Mercedes Benz In Reno Nv For Sale

What Is The Sales Tax In Reno Nv

Used Chevrolet Camaro For Sale In Reno Nv Edmunds

2022 Ford F 250sd Platinum In Reno Nv Reno Ford F 250sd Corwin Ford Reno